In the global market, the Nationwide Credit Card targets everyday spending, balance consolidation, and fee-free foreign purchases while keeping pricing straightforward.

As of 2025, Nationwide lists two active offers: a Purchase and Balance Transfer Credit Card with 0% on purchases and balance transfers for 15 months, and a Balance Transfer Credit Card with 0% on balance transfers for 24 months plus 0% on purchases for three months.

Commission-free purchases abroad and clear fee tables round out the proposition for frequent travellers and budget-conscious cardholders.

Nationwide Credit Card at a Glance

Nationwide issues Visa credit cards to existing members and publishes transparent introductory windows designed to reduce interest on planned purchases or transferred balances.

The provider sets the representative APR at 24.9% variable, with your exact rate and limit determined by profile data at application. Purchases made in foreign currencies attract no non-sterling transaction fee, although cash withdrawals still incur a separate cash fee and interest from the transaction date.

The product set is intentionally simple and avoids annual fees, which helps first-time applicants compare costs without guessing about recurring charges.

Eligibility and Membership Rules

Nationwide restricts credit-card applications to UK residents aged eighteen or over who earn at least £5,000 a year before tax and hold an eligible Nationwide product such as a current account, savings account, or mortgage.

Applications are not accepted if a Nationwide credit card is already open, or if any credit-card application was declined within the last thirty days.

Eligibility pages also state that customers who held a Nationwide credit card within the previous twelve months are not eligible for a new introductory offer. Because these are member products, setting up the required relationship before applying is essential to avoid instant ineligibility.

Step-by-Step Online Application

Clear preparation speeds the process and reduces follow-up checks. Gather accurate documents and log in through secure channels to complete and submit the application in one sitting.

- Prepare documents and figures: Have a valid photo ID, recent proof of address, and up-to-date income details, including employment and regular outgoings, ready for entry. Ensure numbers match payslips and statements to prevent manual verification delays.

- Log in to Nationwide Internet Banking: Start inside the internet bank to check eligibility without impacting your score, then continue to the full form shown with your personalised offer range. Registration is quick if online access has not been set up previously.

- Complete the application accurately: Enter personal, residential, and financial information carefully, pausing to review employment dates, addresses, and declared commitments. Internal checks use these fields to calculate an indicative limit and the APR you may receive.

- Submit and monitor the decision: Most outcomes arrive quickly, although extra checks can take longer when employers or data sources require confirmation. Decisions and next steps appear in online banking, and phone support remains available during stated hours if clarification is needed.

Interest, Fees, and Abroad Use

Introductory pricing is straightforward: 0% on both purchases and balance transfers for 15 months on the combined card, and 0% on balance transfers for 24 months plus 0% on purchases for three months on the transfer-led card.

Balance Transfer Fee

After those windows, standard purchase and balance-transfer interest reverts to your personal variable rate, with the representative APR 24.9% used for illustrations.

Balance transfer fee rules matter: transfers made within 90 days typically show 2.99% (minimum £5) on the current offers, while transfers after 90 days incur 2.4% (minimum £5) and pay interest immediately.

Commision-Free Purchases

Nationwide confirms commission-free purchases abroad on all credit cards, though cash withdrawals still attract a 2.5% cash fee and interest from the date of withdrawal.

Late-payment and over-limit default fees are £0, but missed payments can still harm your credit file and increase borrowing costs.

Card Options Compared

A concise comparison helps match the introductory period to your goal while keeping fee rules visible.

| Card type | Purchase intro | Balance transfer intro | balance transfer fee | Foreign purchases | Representative APR |

| Purchase and Balance Transfer Credit Card | 0% for 15 months | 0% for 15 months | 2.99% within 90 days; 2.4% after | commission-free purchases abroad | 24.9% variable |

| Balance Transfer Credit Card | 0% for 3 months | 0% for 24 months | 2.99% within 90 days; 2.4% after | commission-free purchases abroad | 24.9% variable |

Figures and fee rules are checked on 2025 against Nationwide’s live product pages. Always confirm the current offer before applying, since promotional windows and fees can change during the year.

Soft vs Hard Credit Checks

Nationwide’s eligibility checker uses a soft credit check that does not affect your score and is visible only to you on your report.

Submitting the full application triggers a hard credit check that becomes visible to lenders and typically remains on your file for up to twelve months, which can temporarily lower approval odds if repeated across several providers.

Running the eligibility step first helps gauge acceptance chances and avoids unnecessary hard searches when the initial outcome appears unfavourable.

Tips to Get Approved Faster

Practical actions that flow through to the bureaus and Nationwide’s assessment tend to move results faster and more predictably.

- Stabilise credit utilisation by paying down revolving balances well below thirty percent before applying.

- Check files for errors across the major agencies and dispute any mismatches that could depress your score.

- Avoid multiple applications in close succession to limit hard searches that reduce near-term acceptance odds.

- Match income evidence to declared figures using recent payslips or statements to minimise manual verification.

- Use the Nationwide eligibility checker first to view likely terms without impacting your credit file.

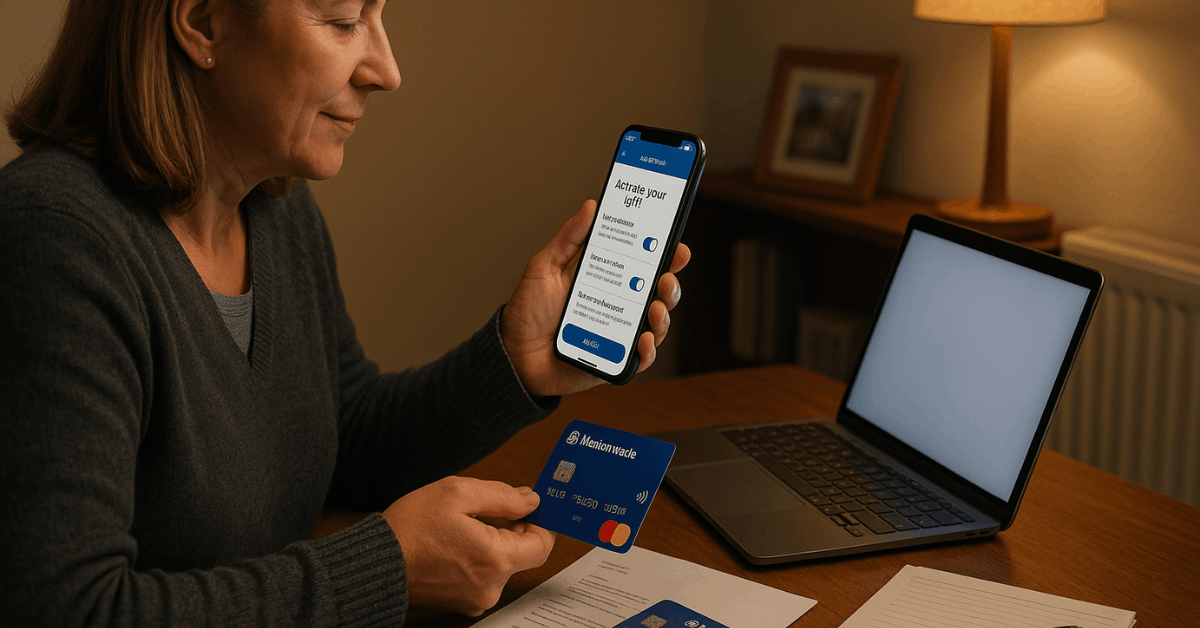

After Approval: Activation and First-Week Setup

Physical cards typically arrive within several working days, followed by a separate PIN mailer where applicable. Activation can be completed online or inside the mobile app, after which spending, balance transfers, and card-control features become available immediately.

Consider enabling real-time alerts, setting a payment due-date that aligns with payday, and turning on location-based security or transaction controls to reduce misuse risk.

App visibility into spending categories and minimum-payment alerts helps prevent accidental interest accrual during or after promotional periods.

Common Decline Reasons and Fixes

Unfavourable outcomes often trace back to limited or impaired histories, high utilisation across existing cards, or inconsistent application data.

Clean up mismatches between reported addresses, employment dates, and open accounts, then reduce revolving balances to demonstrate capacity headroom. Allow at least thirty days before trying again, since repeated hard checks can cumulatively lower scores and confuse underwriting logic.

If the underlying product fit is incorrect, consider waiting until income stabilises or an existing relationship with Nationwide is established to meet members-only requirements.

Support and Contact Details

Nationwide publishes extended phone support for card queries, disputes, and fee clarifications. General card enquiries route to 03456 00 66 11 in the UK or +44 2476 43 89 97 from abroad, alongside online help pages that explain late-payment handling, over-limit processes, and foreign-use fee examples.

Phone lines operate seven days a week with slightly shorter hours on Sundays and bank holidays, and branch assistance remains available for in-person support when required.

Section 75 protection for eligible UK card purchases between £100 and £30,000 also applies, enabling consumers to claim when a merchant fails to deliver as promised.

Conclusion

For UK-based members seeking a clean application path and predictable pricing, the Nationwide Credit Card keeps choices focused and fees transparent.

Introductory windows are competitive for both purchases and balance transfers, while commission-free foreign purchases strengthen everyday utility for travellers and online shoppers.

Running the soft eligibility step first, preparing accurate documents, and aligning repayments to payday provide a quick, low-friction route from application to active card use. Check the live Nationwide pages before applying, since promotions, fees, and interest rates may be updated during the year.